Understanding Amortization in Real Estate: Definition and Calculation Methods

If you’ve researched mortgage loan repayment, chances are you have come across the term “amortization.” Amortized loans are among the most prevalent real estate loans and provide predictable monthly payments with declining interest payments instead of compounding over the life of the loan term.

Real estate investors should understand how amortization works in real estate investments and its potential impacts on monthly payments; so let’s explore this topic in more depth.

Amortization

Amortization is a gradual process allowing borrowers to gradually pay back the loan in equal installments while decreasing both principal and interest balances gradually over the loan term.

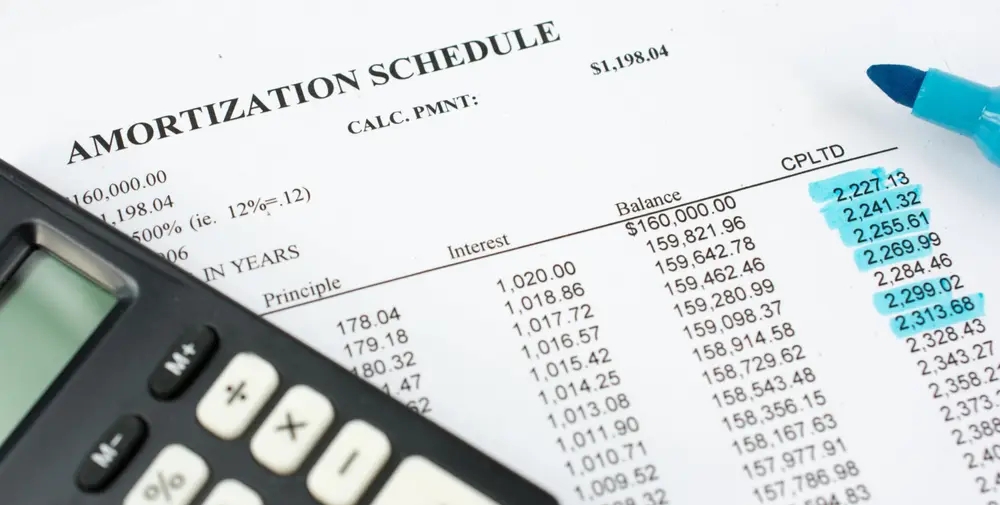

Real estate mortgages use amortization to ensure that borrowers maintain a fixed monthly mortgage payment (assuming a fixed interest rate), though over time their principal payments become higher as interest payments decrease. By making extra payments towards principal, additional payments could reduce this figure and ultimately decrease both total interest owed and loan duration.

On the first day, all outstanding balance is due.

When choosing a mortgage loan, amortization should be carefully considered. There are various forms available:

Positive amortization Lenders offering positive amortization loans require their borrowers to make loan payments that amortize a portion of the principal each month, thus decreasing repayment risk and the loan balance over time.

At first, your loan payments will likely go more towards interest than principal. But gradually over time, this loan balance ratio shifts, until eventually each principal payment exceeds interest payments.

Full amortized loans utilizing positive amortization will have their entire loan balance paid off upon the conclusion of their term.

Negative amortization

Under negative amortization, borrowers pay their loan payments on time; however, their balance continues to increase since their minimum monthly payment doesn’t cover interest costs.

Negative amortization loans add unpaid interest charges directly to the total loan balance, potentially leaving you owing more than what your home is actually worth. Therefore, it is wise to avoid them whenever possible.